The West Virginia Senate passed a tax cut bill, including a personal income tax reduction of over 21 percent — and various property tax rebates — this weekend in Charleston.

During a Saturday afternoon committee meeting, the State Senate’s Finance Committee introduced and passed a compromise tax bill without reporting any expected State revenue impact. Unofficial and official estimates suggest a $750 million annual budget shortfall — which would be temporarily counterbalanced by West Virginia’s recent coal and mineral record- high severance tax surpluses.

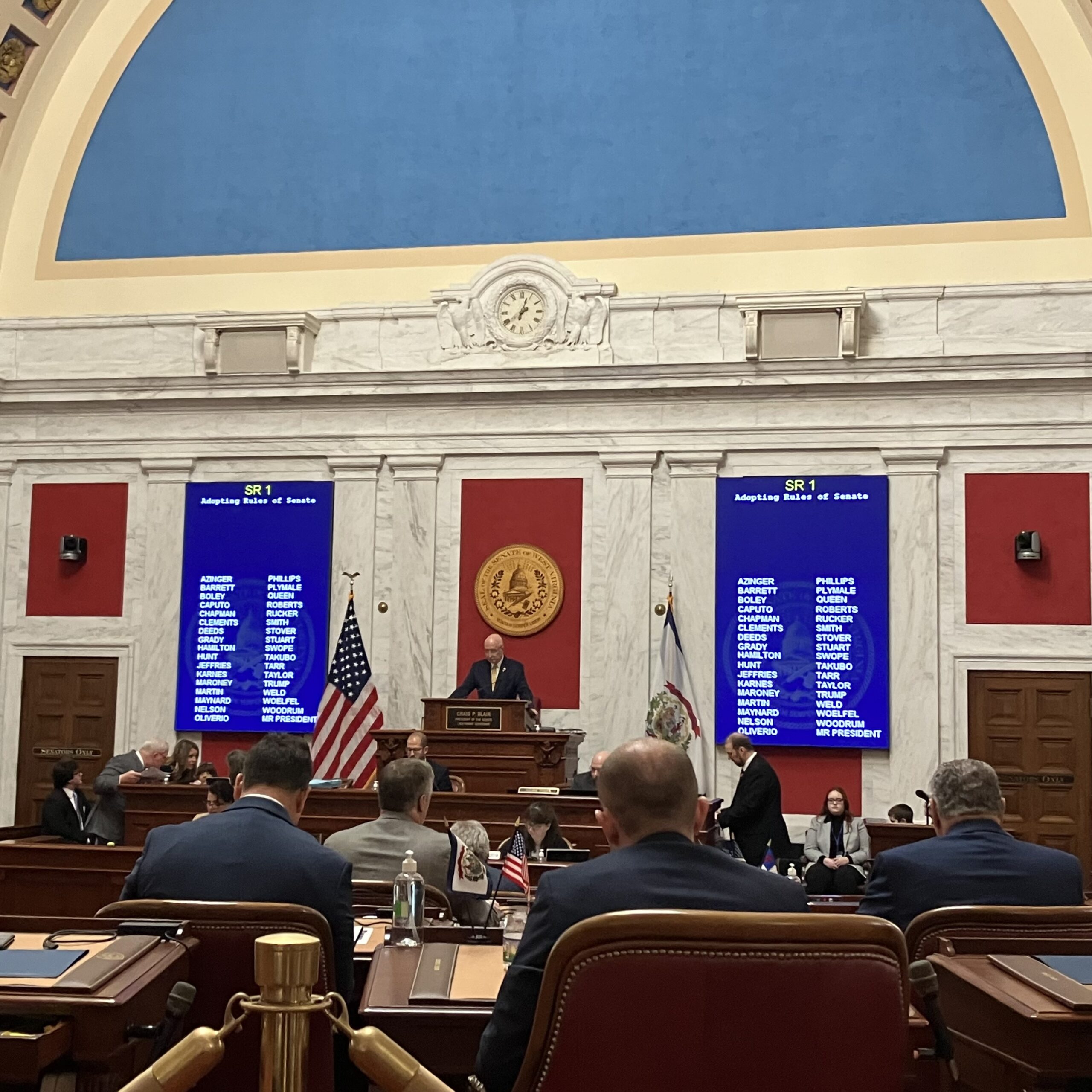

The Senate on Saturday suspended constitutional rules, and in an unusual first round reading passed the tax bill compromise by 32-1, opposed only by Senator Mike Caputo a Democrat from Marion County. It apparently ends the annual car tax and will enable elements of a failed Constitutional Amendment on property taxes that voters had rejected on the November ballot.

The final income tax cut falls below the House of Delegates’ and Governor’s ambitious 50% state income tax cut plan, but the relief plan is larger than the more limited Senate tax cut bill that was proposed in February to address the record state surpluses and is intended to preserve the best elements in the failed November 2022 state-wide property tax referendum.

While originally advocating for a much larger tax cut on personal income, and despite the legal complexities of various property tax and depreciation reduction schemes (including those that failed on the November ballot) Governor Justice today endorsed the Senate’s unusual weekend measures, saying:

“I am extremely happy that after weeks of negotiations with all parties we’ve been able to reach a deal with the House and Senate that will be the largest tax cut in West Virginia history … This deal returns over $750 million to hardworking West Virginians through a major cut to our personal income tax, rebate of the car tax, a 50% rebate of the property tax on machinery and inventory to small businesses, and tax credits to West Virginia Veterans. It also puts us on a pathway toward the complete elimination of our personal income tax. It’s a win-win for all West Virginians and I couldn’t be more pleased with the outcome.

“I applaud the House and Senate for all their hard work. I am hopeful that both bodies pass it quickly, so that we can all celebrate its signing together very soon.” Governor Justice said.