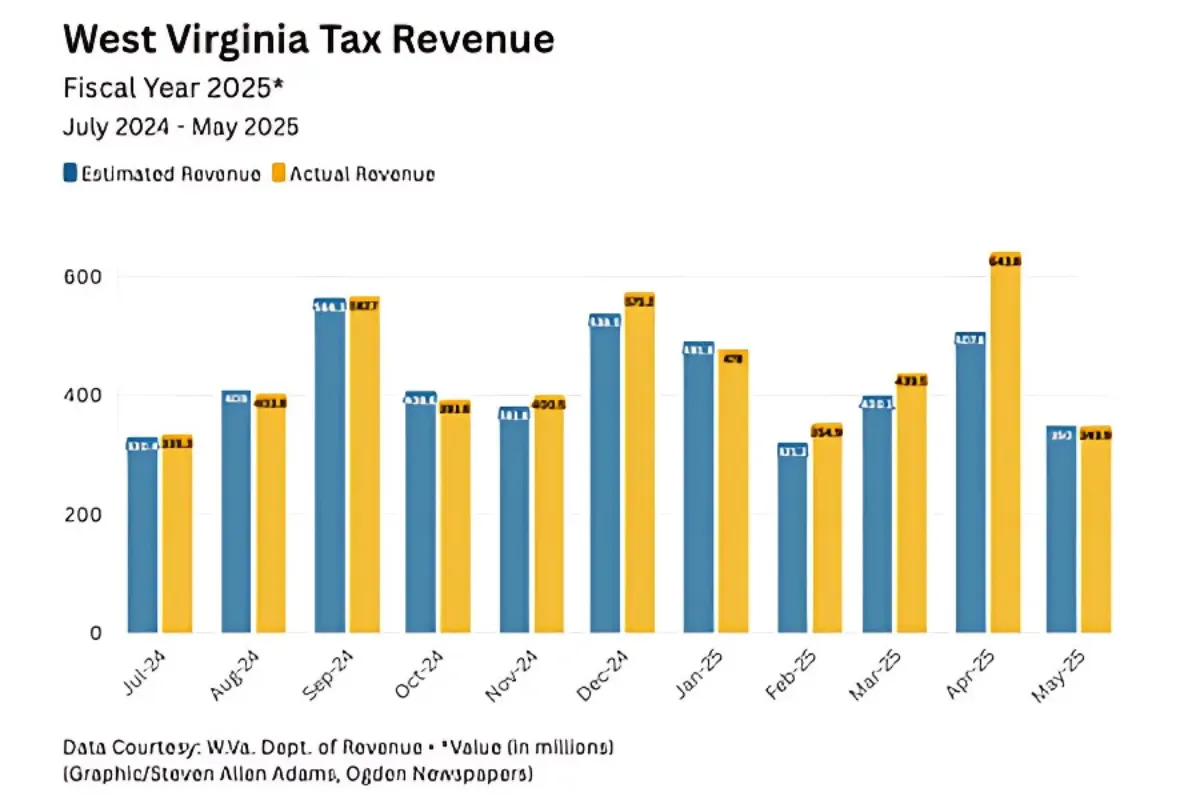

Like the state’s rolling hills, West Virginia’s monthly tax revenues are full of ups and downs. April brought a pleasant surprise — tax collections were 26.8% higher than expected. But May told a different story. Revenue figures missed projections by $154,000, with personal income taxes falling 6.5% short of the estimate.

Although the fiscal year is still on track to end with a $236.9 million surplus, most of that money has already been designated for specific needs. Once July 1 arrives and the new fiscal year begins, the state’s budget essentially resets, and every dollar will need to be carefully accounted for.

Officials, including Gov. Patrick Morrisey, have already put the expected surplus to work. Funding has been allocated to critical areas such as Medical Services under the Department of Human Services and projects with the Division of Highways. These early decisions show a commitment to using extra funds wisely and not wasting them on nonessential items.

But as May’s shortfall shows, revenue fluctuations can’t be ignored. Morrisey emphasized the need for caution and long-term planning.

“Last month’s General Revenue Fund collections show that we must remain vigilant and focus on ensuring financial stability,” he said. “We will continue to make fiscally responsible decisions to set up West Virginia for a prosperous future.”

That kind of vigilance is especially important now. As officials work to meet the needs of residents, they must also guard against fraud, waste, and abuse — all of which can drain resources if left unchecked.

Balancing responsible spending with strong oversight is no small task, especially when demands for public services remain high. But staying alert and conservative with revenue is key to keeping the state financially healthy.

West Virginia’s leaders will need to maintain that focus — making smart choices that not only meet today’s needs but also secure a stable future for everyone across the Mountain State.