Families in Oregon could be in for a welcome surprise as the IRS begins issuing $3,900 relief payments under a new federal assistance initiative. These one-time payments are part of an expanded effort to offer financial support to low-to-middle-income households affected by ongoing economic challenges, including inflation, job loss, and rising living costs.

Who Qualifies for the $3,900 IRS Payment?

To qualify, at least one family member must have filed a 2023 federal income tax return with a valid Social Security number and meet certain income thresholds. Priority is given to families with dependents, including children, elderly parents, or disabled individuals. Families earning less than $150,000 (jointly) or $75,000 (single filers) are likely to be eligible.

How to Check If You’re on the List

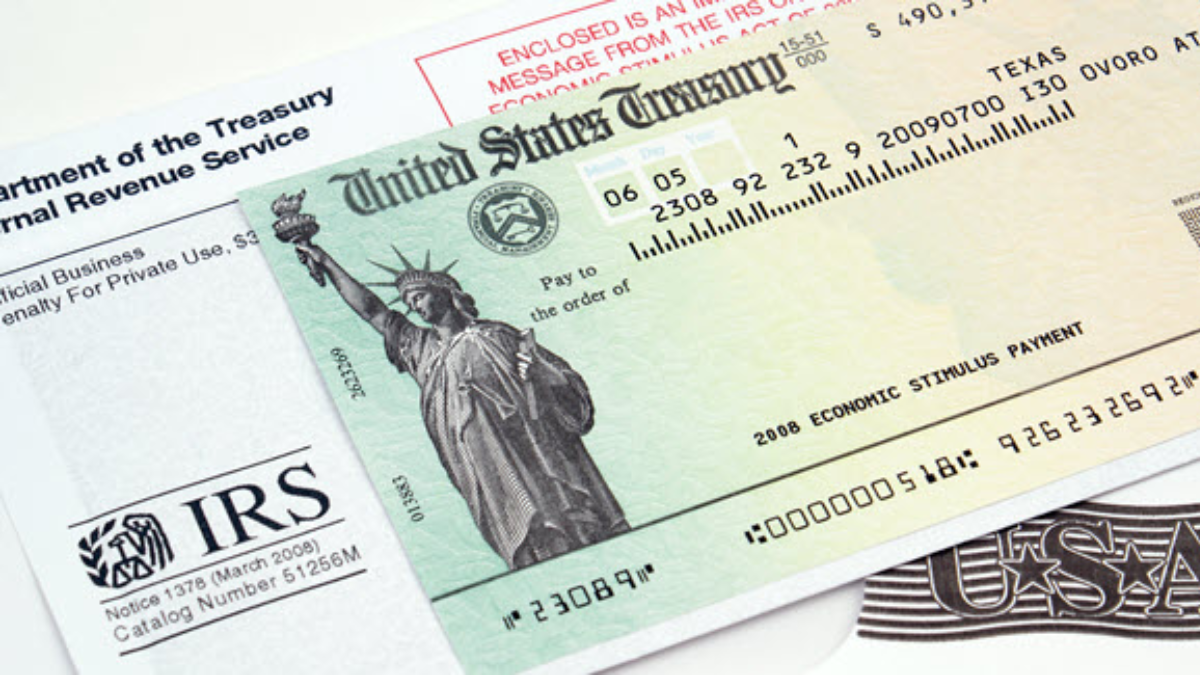

The IRS has started sending out confirmation letters and direct deposit notifications. You can check your payment status via the IRS “Get My Payment” portal or through your bank account if you’ve opted for direct deposit. Those expecting paper checks should monitor their mail in the coming weeks.

When and How Will You Receive the Payment?

Most eligible households will receive the $3,900 as a direct deposit into their bank accounts on file with the IRS. Others will get a paper check by mail. Payments began rolling out in phases starting this month and are expected to continue for the next several weeks. If your banking information has changed since your last filing, you may need to contact the IRS to update your details.

What Should You Do If You Haven’t Received It?

If you’re eligible but haven’t received your payment, double-check your tax return status, mailing address, and bank details. You can also call the IRS helpline or visit a local taxpayer assistance center. Some delays may be due to pending verifications or mismatches in personal information.

Summary Table – $3,900 IRS Family Payments in Oregon

| Criteria | Details |

|---|---|

| Payment Amount | $3,900 (one-time payment) |

| Eligible Recipients | Families with dependents meeting IRS income limits |

| Application Needed? | No (based on 2023 tax return) |

| Disbursement Method | Direct deposit or mailed check |

| Timeline | Payments rolling out this month |

The $3,900 IRS payment for Oregon families could make a meaningful difference for households dealing with rising costs and economic uncertainty. If you think you’re eligible, act now: verify your tax status, check your bank account, and stay alert for IRS communications. Don’t let this opportunity pass you by—every dollar matters.

FAQ’s:

1. Do I need to apply for the $3,900 IRS payment?

No, payments are based on your 2023 federal tax return. If you’re eligible, the IRS will process it automatically.

2. What if I didn’t file taxes in 2023?

You may not qualify unless you file a late return. Consider filing as soon as possible to become eligible.

3. Can I track the status of my payment?

Yes, use the IRS “Get My Payment” tool online to monitor your deposit or check status.

4. Will this payment affect my other benefits?

No, the IRS has confirmed that this stimulus is not taxable and won’t impact programs like SNAP or Medicaid.

5. What if my address or bank account has changed?

You should update your information with the IRS through your online account or by calling their support line to avoid delays.