Michigan residents could receive up to $3,100 in tax refunds this year, thanks to recent federal and state adjustments aimed at easing financial stress. If you haven’t yet checked your eligibility, now is the time—many households may qualify automatically, while others may need to take action before the deadline.

Who’s Eligible for the Michigan Tax Refund?

To qualify for the $3,100 refund, you must be a Michigan resident who filed a 2023 federal and state income tax return. The refund primarily targets low- and middle-income earners, with income thresholds of $75,000 or less for individuals and $150,000 or less for joint filers. Individuals who claimed children, received Social Security benefits, or received unemployment during 2023 may be prioritized.

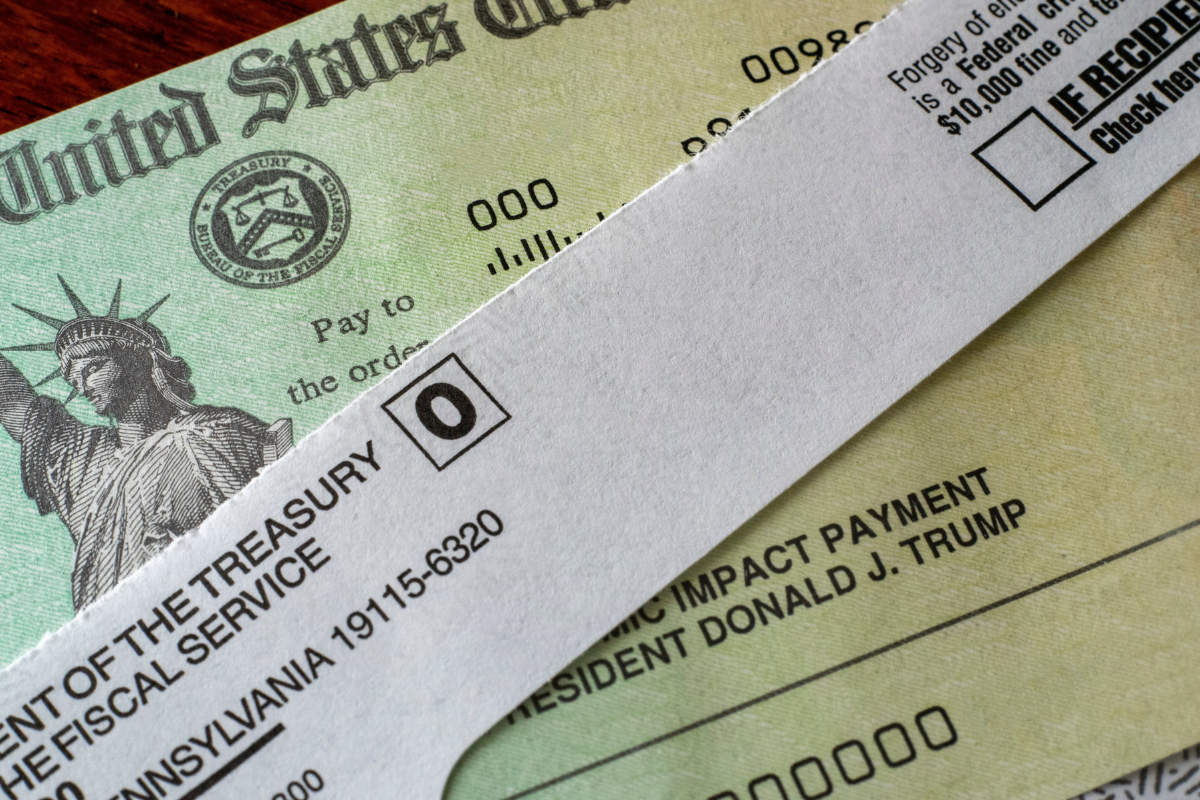

How the $3,100 Refund Will Be Distributed

The Michigan Department of Treasury, in coordination with the IRS, will issue the refund via direct deposit or paper check, depending on what method was selected during tax filing. Most payments are expected to begin rolling out in late June 2025, with the process continuing through mid-July. It’s important to ensure your mailing address and bank information are up to date to avoid delays.

How to Confirm Your Refund Eligibility

The refund is generally automatic for qualified filers. However, if you did not file taxes or had significant life changes in 2023—such as job loss, new dependents, or a change of address—you may need to update your tax information or submit a correction. You can verify your status by checking the “Where’s My Refund?” tool on the IRS or Michigan Treasury website.

Refund Details Overview

| Category | Details |

|---|---|

| Refund Amount | Up to $3,100 |

| Who Qualifies | 2023 tax filers meeting income and residency rules |

| Filing Deadline | Must file 2023 returns to be considered |

| Delivery Method | Direct deposit or mailed check |

| Payment Start Date | Late June 2025 |

With refunds of up to $3,100 being distributed across Michigan, now is the time to make sure you’re on the list. Whether you’ve already filed or still need to update your information, don’t leave this money unclaimed. A few minutes of verification could result in a major financial boost.

FAQ’s:

1. What if I already filed my 2023 taxes?

If you meet the income and residency requirements, your refund will likely be processed automatically.

2. Do I need to apply separately for the refund?

No separate application is required, but your 2023 tax return must be complete and accurate.

3. What if I changed my bank account or moved?

Update your direct deposit or address info with the IRS or Michigan Treasury to avoid delays.

4. Can retirees or people on disability qualify?

Yes, as long as they meet the income and residency criteria outlined for the refund.

5. Will this affect my taxes next year?

No. The $3,100 refund is considered tax-free and won’t count as income for 2025 tax purposes.