Pennsylvania has launched a one-time $2,600 stimulus payment targeted at gig workers and independent contractors who have faced financial instability due to inconsistent income and rising expenses. As part of a statewide economic assistance package, this payment aims to help self-employed individuals—from rideshare drivers to freelance creatives—manage day-to-day costs and bridge income gaps. If you earned income independently in 2023, you could qualify for this relief.

Who Qualifies for the $2,600 Stimulus?

Eligibility is based on residency, gig income documentation, and adjusted gross income. Applicants must be Pennsylvania residents who performed at least $5,000 in gig work during 2023. Annual income must not exceed $60,000, and applicants should have filed either a federal tax return or a Schedule C for self-employment income. Those who received unemployment in 2023 are also prioritized to reach individuals most in need.

| Eligibility Factor | Requirement |

|---|---|

| Residency | Pennsylvania resident as of Dec 31, 2023 |

| Income from Gigs | Minimum of $5,000 in 2023 independent earnings |

| Income Limit | ≤ $60,000 adjusted gross income |

| Documentation | Filed Form 1040 with Schedule C or 1099s |

| Benefit Status | Prioritized if received unemployment or public aid |

How and When Will Payments Be Issued?

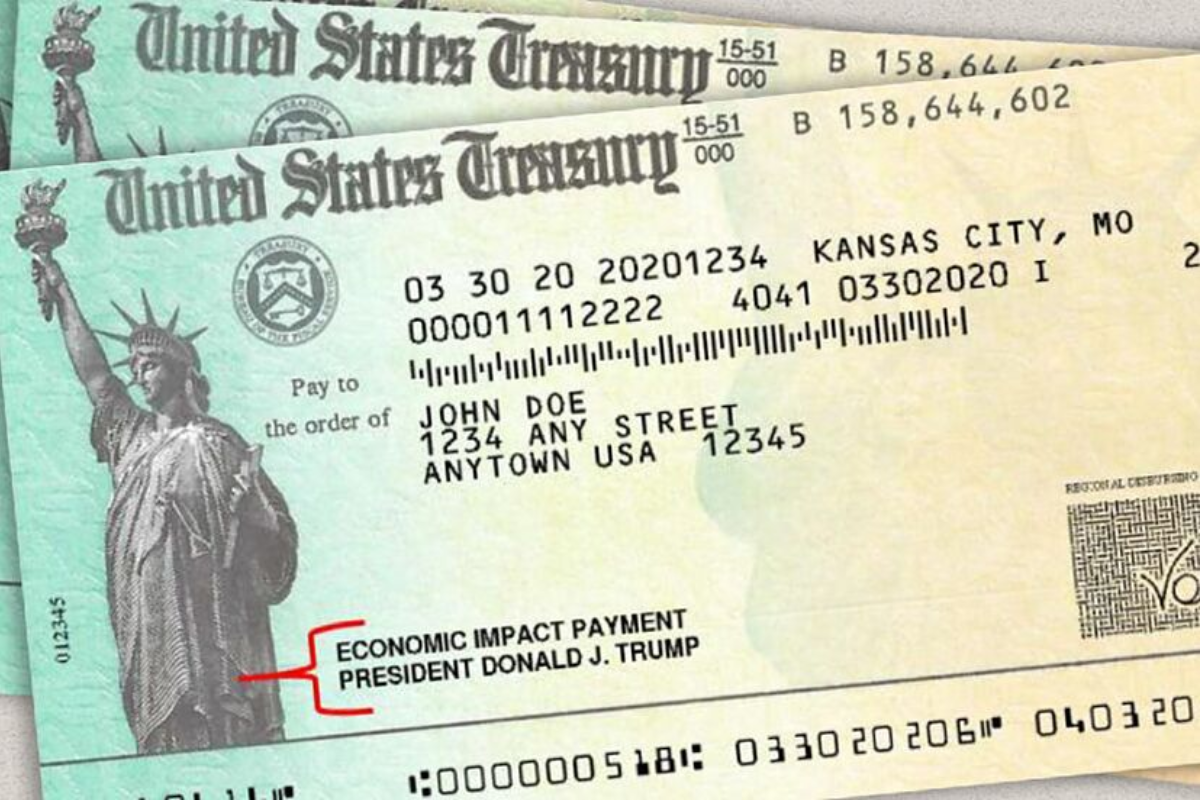

The Pennsylvania Department of Community and Economic Development (DCED) plans to distribute payments in waves starting July 2025 and concluding by October. Applicants who have submitted required documentation and meet criteria will be notified via email with a confirmation of payment delivery method. Direct deposit is preferred for speed, but paper checks will be sent to those without bank account information. Expect transactions to appear in your account under “PA Gig Stimulus.”

Do You Need to Apply or Wait for Automatic Qualifying?

An application is required in this program. Pennsylvania gig workers must register through the state stimulus portal, upload income documentation and tax returns, and certify their status as gig workers. A simplified verification form is available for those already registered in the PA unemployment or public aid systems. Once submitted, applications undergo review and eligible recipients will receive notifications within 4–6 weeks.

What Gig Workers Should Keep in Mind

Ensure accurate filing of your 2023 tax return with Schedule C and maintain copies of 1099-MISC or 1099-K forms. If you changed your mailing address or bank account recently, update your details in the portal before submitting your application. Be mindful of deadlines—applications open July 1, 2025, and close August 31, 2025. Misreporting income or failing to certify your gig activity may delay or invalidate your payment. Help is available via PA DCED assistance lines and local community action agencies.

The $2,600 stimulus payment offers crucial financial support to Pennsylvania’s gig workforce, helping individuals stabilize finances amid unpredictable income streams. Applicants have a two-month window to apply, and the state emphasizes correct documentation, tax filings, and timely portal updates. Eligible gig workers who act quickly—submit income forms, certify gig status, and keep their contact information current—can expect to receive these funds by fall.

FAQ’s:

1. Who counts as a gig worker for this stimulus?

Any independent contractor who performed work through platforms like Uber, DoorDash, TaskRabbit, Fiverr, or similar, earning at least $5,000 during 2023.

2. Do I need to have filed a full tax return?

Yes. You must file a 2023 Form 1040 with Schedule C and include any 1099-MISC or 1099-K earnings to verify your self-employment.

3. Is the $2,600 taxable?

No, this payment is designated as non-taxable aid and will not affect your federal or state tax owed.

4. Can I apply if I only started gig work in 2024?

No. To qualify you must show at least $5,000 in gig income during the 2023 calendar year.

5. How do I track my application or payment?

Use your login on the state’s stimulus portal. You will receive updates within 4–6 weeks after applying, and a payment confirmation after disbursement.