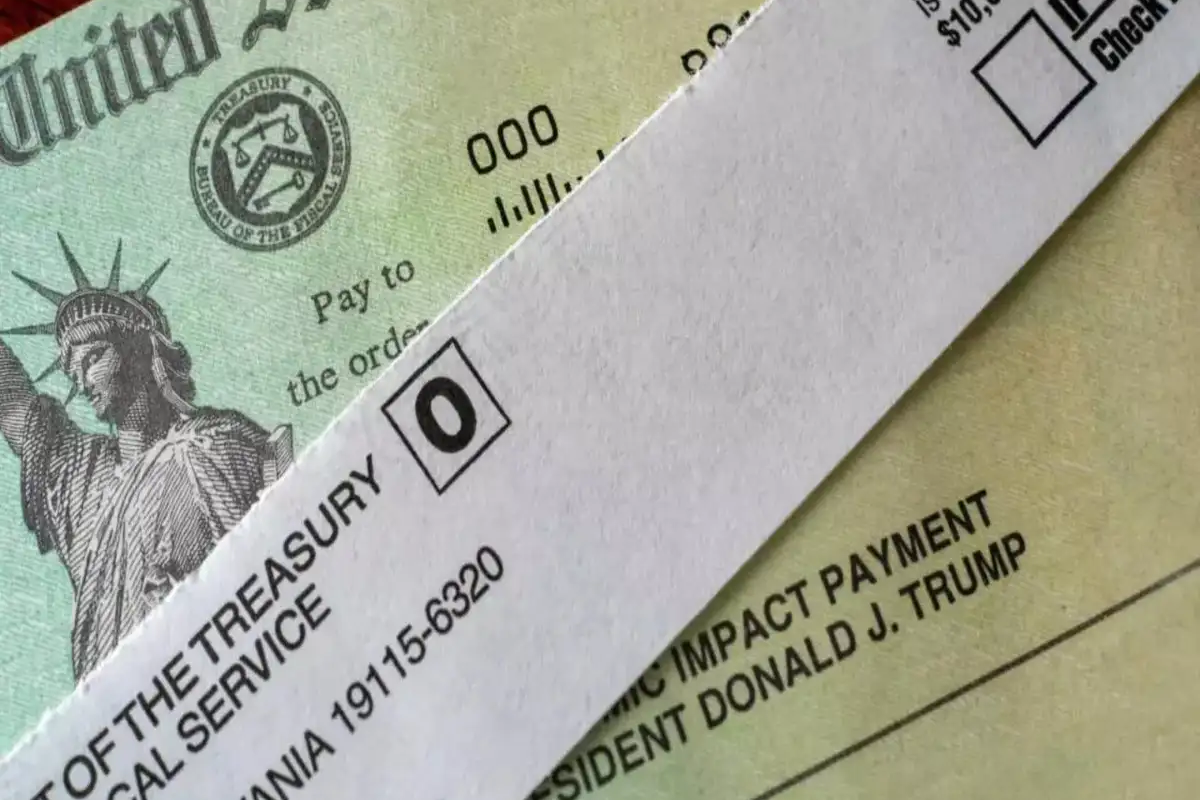

Arizona residents could be receiving up to $2,500 in IRS stimulus payments as part of a financial relief effort rolling out this May. The payments are aimed at low- to middle-income households to help manage the rising costs of essentials like rent, groceries, and transportation. If you live in Arizona and meet the qualifications, checking your eligibility now could mean money in your account within days.

Who Qualifies for the $2,500 Stimulus in Arizona?

The payment is available to Arizona residents who filed a 2023 federal tax return and meet specific income guidelines. Individuals making less than $75,000 and couples earning under $150,000 annually may qualify for the full amount. Households with dependents, seniors on fixed incomes, and those receiving SNAP or Medicaid benefits may also be eligible for additional funds. Arizona residents must have maintained state residency through the 2023 calendar year.

When Will Payments Be Sent?

Payments began rolling out on May 15, 2025, and will continue through early June. Most recipients will get their stimulus through direct deposit, using the information provided on their tax return. Paper checks will be mailed to those without banking info on file. Payments will be sent in weekly batches, with earlier filers and those with verified direct deposit details expected to receive funds the quickest.

How to Check Your Payment Status

Arizona residents can verify their eligibility and payment status by logging into their IRS account or visiting the Arizona Department of Revenue website. If you haven’t filed your 2023 taxes yet, you still have time—returns must be submitted by May 31, 2025, to be eligible for this round of payments. Keeping your contact and banking information current is crucial to avoid delays or misrouted checks.

Arizona Stimulus Payment Breakdown

| Detail | Information |

|---|---|

| Maximum Payment | $2,500 |

| Income Limit (Single) | $75,000 or less |

| Income Limit (Married) | $150,000 or less |

| Tax Year Used | 2023 Federal Return |

| Payment Start Date | May 15, 2025 |

| Filing Deadline to Qualify | May 31, 2025 |

Arizona’s $2,500 IRS stimulus is a welcome opportunity for qualifying households to receive direct relief during a time of economic pressure. Whether you’re a parent, senior, or working individual, this payment could help ease financial burdens—but only if you’ve filed your taxes and meet the income requirements. Be sure to check your eligibility and confirm your payment status before the deadline passes.

FAQ’s:

1. Do I need to apply separately for the Arizona stimulus?

No, if your 2023 tax return is filed and you meet the criteria, the payment will be issued automatically.

2. What if I didn’t file taxes for 2023?

You must file by May 31, 2025, to be considered for this payment round.

3. Will this affect my benefits like SNAP or Medicaid?

No, the stimulus payment will not count as income for benefit eligibility.

4. How can I update my banking information?

You can update your direct deposit details through your IRS account or by contacting the Arizona Department of Revenue.

5. Can I check my payment status online?

Yes, both the IRS and Arizona state tax websites offer tools to track payment status and eligibility.