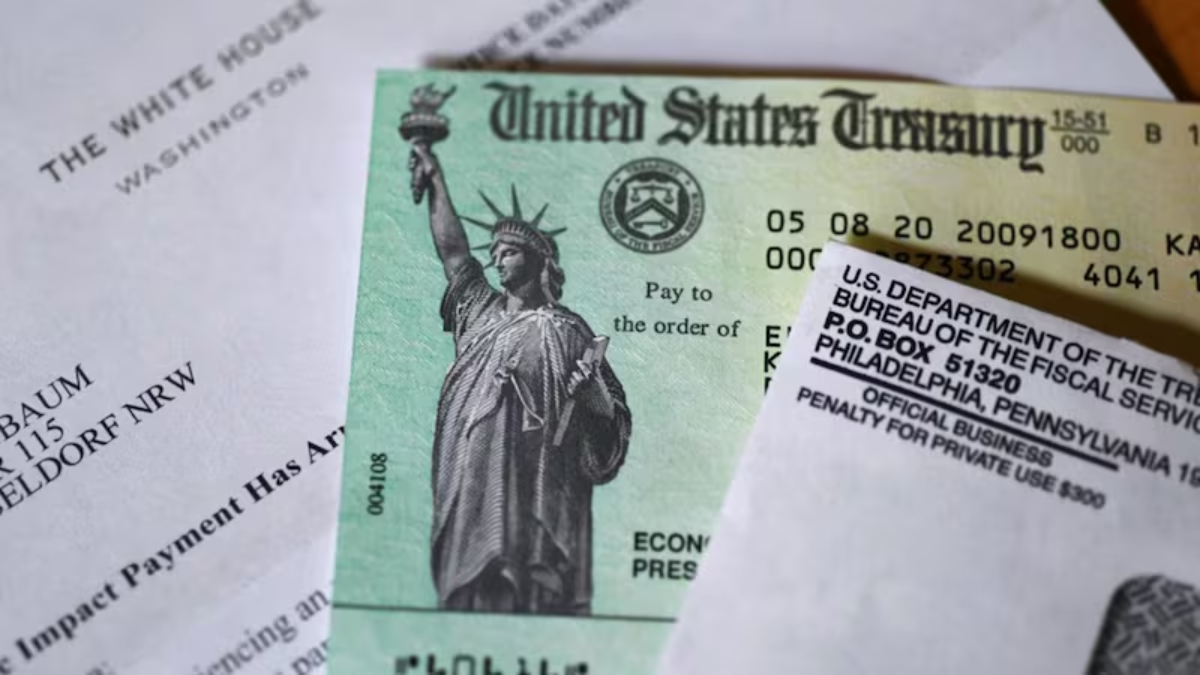

Millions of Americans may still be eligible for $1,400 IRS stimulus checks and a share of the $1 billion in unclaimed tax refunds. At the same time, cryptocurrency enthusiasts are buzzing about the latest $5,000 DOGE checks update. If you’re wondering whether you qualify for these payments and how to claim them, this article will cover everything you need to know.

$1,400 IRS Stimulus Checks: Who Can Still Claim?

The $1,400 stimulus checks were part of the American Rescue Plan Act (2021), but many people never received their payments. The IRS is still allowing eligible individuals to claim their stimulus funds if they missed out.

Eligibility Criteria for the $1,400 Stimulus Check:

- Must be a U.S. citizen or resident alien.

- Income limits:

- Individuals earning up to $75,000 qualify for the full payment.

- Married couples earning up to $150,000 also qualify.

- Dependents were eligible for additional payments (e.g., parents received $1,400 per dependent child).

- Must file a 2021 tax return to claim the missing payment.

How to Claim the Stimulus Check?

If you never received your $1,400 stimulus check, you can still claim it by:

- Filing a 2021 tax return (even if you don’t usually file taxes).

- Using the IRS’s “Get My Payment” tool to track payments.

- Checking if the IRS issued the payment but it was lost or returned.

$1 Billion in Unclaimed Tax Refunds: Are You Owed Money?

According to the IRS, nearly $1 billion in unclaimed tax refunds remains available for taxpayers who never filed returns in previous years. Many people overpaid taxes or missed deductions, resulting in refunds they never collected.

Who Might Have an Unclaimed Refund?

- Individuals who did not file a tax return but had federal income tax withheld.

- Students, part-time workers, or those with low earnings who qualify for a refund.

- Individuals eligible for the Earned Income Tax Credit (EITC) who never claimed it.

- Taxpayers who failed to update their mailing address and never received their refund checks.

How to Claim Your Unclaimed Refund?

- File a tax return for the missing years (usually within a 3-year deadline).

- Use the IRS “Where’s My Refund?” tool to check for unclaimed payments.

- Contact the IRS if you believe you are owed money from a previous return.

$5,000 DOGE Checks Update: What You Need to Know

The $5,000 DOGE checks have been a trending topic, sparking excitement among cryptocurrency holders. While there is no official government program issuing Dogecoin payments, there have been reports of private giveaways, corporate incentives, and crypto-based rebates offering Dogecoin as a reward.

Who Might Be Eligible for a $5,000 DOGE Check?

- Crypto investors who participated in Dogecoin-related promotions.

- Holders of DOGE rewards programs from certain crypto exchanges.

- Participants in crypto airdrops or staking programs offering Dogecoin.

- Individuals eligible for crypto tax refunds, depending on local tax laws.

How to Check If You Qualify?

- Monitor updates from crypto exchanges and Dogecoin communities.

- Check for tax deductions or credits related to crypto investments.

- Avoid scams—only rely on verified sources when claiming crypto payments.

Millions of Americans still have unclaimed stimulus checks, tax refunds, and potential crypto rewards waiting to be claimed. If you believe you qualify for a $1,400 IRS stimulus check, a portion of $1 billion in unclaimed refunds, or have questions about $5,000 DOGE checks, take action now. Visit the IRS website, file necessary tax returns, and stay updated on crypto-related opportunities to ensure you don’t miss out on money that could be yours!

FAQ’s:

1. Can I still get my $1,400 stimulus check if I missed the deadline?

Yes! If you never received your payment, you can claim it by filing a 2021 tax return, even if you don’t normally file taxes.

2. How do I check if I have an unclaimed tax refund?

Visit the IRS website and use the “Where’s My Refund?” tool or call the IRS helpline for assistance.

3. Are the $5,000 DOGE checks real?

While no government program offers $5,000 DOGE checks, some crypto exchanges, companies, or influencers may provide promotions or giveaways. Be sure to verify sources before claiming.

4. What happens if I don’t claim my tax refund in time?

The IRS typically allows you three years to claim a refund. After that, the funds become property of the U.S. Treasury and can no longer be claimed.

5. Will the IRS tax my Dogecoin rewards?

Yes, any crypto rewards, staking earnings, or airdrops may be subject to capital gains tax or income tax, depending on how you received them. Consult a tax professional for guidance.